The Basic Principles Of Ach Payment Solution

EFT settlements (EFT stands for digital funds transfer) can be utilized reciprocally with ACH settlements. They both describe the very same payments mechanism.:-: Pros Cost: ACH payments tend to be less costly than cable transfers Speed: faster considering that they do not utilize a "set" process Cons Rate: ACH repayments can take numerous days to process Price: reasonably expensive source: There are two types of ACH payments.

ACH credit score purchases let you "push" money to various financial institutions (either your own or to others). They utilize ACH credit history deals to press money to their workers' bank accounts at marked pay durations.

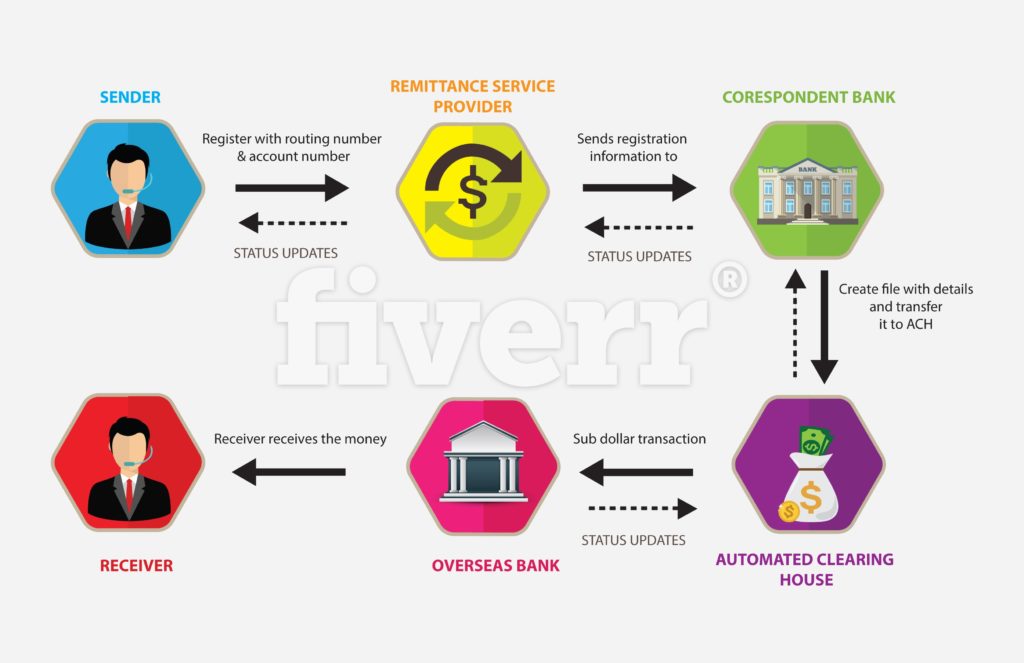

Customers that pay a business (claim, their insurance policy company or home loan lending institution) at specific intervals may select to sign up for repeating repayments. That offers the service the capacity to initiate ACH debit transactions at each payment cycle, pulling the amount owed directly from the client's account. Besides the Automated Clearing House network (which attaches all the banks in the USA), there are 3 other gamers associated with ACH repayments: The Originating Vault Financial Organization (ODFI) is the banking establishment that initiates the transaction.

The Best Guide To Ach Payment Solution

(NACHA) is the nonpartisan governmental entity accountable for looking after and managing the ACH network. When you authorize up for autopay with your phone business, you supply your checking account information (directing as well as account number) and sign a persisting repayment consent.

Both financial institutions then connect to make sure that there suffice funds in your bank account to refine the transaction. If you have sufficient funds, the transaction is processed as well as the cash is directed to your communications provider's savings account. ACH settlements commonly take several organization days (the days on which financial institutions are open) to undergo.

Per the standards established forth by NACHA, economic establishments can select to have actually ACH credit histories processed and provided either within a company day or in one to 2 days. ACH debit purchases, over here on the various other hand, have to be processed by the next service day. After receiving the transfer, the various other financial institution could likewise restrain the transferred funds for a holding period.

The changes (which are taking place in stages) will make possible extensive usage of same-day ACH payments by March 2018. ACH repayments are commonly extra budget-friendly for organizations to procedure than credit report cards.

Rumored Buzz on Ach Payment Solution

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

Some ACH processors bill a flat rate, which generally varies from $0. 25 to $0. 75 per transaction. Others charge a flat percentage fee, ranging from 0. 5 percent to one percent per transaction. Carriers might additionally bill an additional regular monthly charge for ACH settlements, which can vary. Square uses ACH payments for deposits, and there's no cost related to that for Square vendors.

These deny codes are very important for offering the appropriate information to your consumers regarding why their payment didn't go with (ach payment solution). Right here are the four most usual reject codes: This means the client didn't have enough money in their account to cover the amount of the debit entry. When you get this code, you're possibly mosting likely to have to rerun the purchase after the consumer transfers more cash into their account or supplies a different check payment approach.

It's likely they neglected to alert you of the modification. They need to offer you with a brand-new checking account to process the transaction. This code is activated when some mix of the information given (the account number as well as name on the account) does not match the financial institution's documents or a nonexistent account number was gone into.

In this case, the customer requires to provide their bank with your ACH Pioneer ID to enable ACH withdrawals by your business. Rejected ACH settlements can land your service a charge fee.

The Ultimate Guide To Ach Payment Solution

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

To prevent the trouble of untangling ACH declines, it might deserve only approving ACH settlements from trusted customers. Although the ACH network is taken care of by the federal government and NACHA, ACH payments do not need to follow the very same PCI-compliance standards needed for debt card processing. NACHA requires that all celebrations entailed in ACH deals (including services launching the repayments and also third-party processors) execute procedures, treatments, as well as controls to safeguard delicate data.

That indicates you can not send out or receive bank details using unencrypted email or unconfident web kinds. Ensure that his explanation if you utilize a 3rd party for ACH payment handling, it has implemented systems with cutting edge encryption approaches. Under the NACHA rules, begetters of ACH settlements have to likewise take "commercially reasonable" steps to guarantee the credibility of client identity as well as transmitting numbers, and also to determine feasible deceptive activity.

Comments on “Things about Ach Payment Solution”